To meet the global target for clean hydrogen of 10-15% of energy use by 2050 we need to produce 40m tonnes by 2030. The rich OECD countries simply do not have the resources to do it alone. So there must be a global effort to actively support hydrogen production in Emerging Markets and Developing Countries (EMDCs), explain Carolina Lopez Rocha and Dolf Gielen at the World Bank Group and Ignacio de Calonje at the IFC. They summarise the World Bank’s flagship report “Scaling Hydrogen Financing for Development.” The authors look at existing projects, their progress, the existing financial support, and the barriers. They end with a summary of the World Bank’s “10 GW lighthouse initiative”, designed to boost the clean hydrogen industry in EMDCs by getting more projects to the FID stage (Final Investment Decision) by 2030.

To meet the global target for clean hydrogen of 10-15% of energy use by 2050 we need to produce 40m tonnes by 2030. The rich OECD countries simply do not have the resources to do it alone. So there must be a global effort to actively support hydrogen production in Emerging Markets and Developing Countries (EMDCs), explain Carolina Lopez Rocha and Dolf Gielen at the World Bank Group and Ignacio de Calonje at the IFC. They summarise the World Bank’s flagship report “Scaling Hydrogen Financing for Development.” The authors look at existing projects, their progress, the existing financial support, and the barriers. They end with a summary of the World Bank’s “10 GW lighthouse initiative”, designed to boost the clean hydrogen industry in EMDCs by getting more projects to the FID stage (Final Investment Decision) by 2030.

Clean hydrogen[1] is widely seen as a cornerstone of the global energy transition and decarbonisation, accounting for 10-15% of energy use by 2050. The World Bank Group has put forward a 10 GW lighthouse initiative to help developing countries participate in the growing hydrogen economy across the value chain in support of their climate and energy goals. The proposal is part of the World Bank’s flagship report “Scaling Hydrogen Financing for Development,” which discusses strategies to accelerate hydrogen deployment in emerging markets and developing countries (EMDCs).

270 GW of electrolyser capacity worldwide by 2023

Latest analyses suggest the need to produce 40 million tonnes (Mt) of clean hydrogen by 2030 to achieve a net zero pathway, with two thirds being renewable hydrogen. According to the 1-10-20-30 rule 1 Mt of renewable hydrogen production capacity requires 10 GW electrolyzers. Therefore the world must have 270 GW of electrolyser capacity in operation to secure this goal by 2023. To understand the magnitude of the task, the current installed capacity of dedicated hydrogen electrolysers worldwide only reaches around 1 GW. Therefore, the world needs an accelerated global ramp-up, with hundreds of large new projects in the coming years.

…and OECD countries do not have the resources to do it alone

The world energy transition requires a global roll-out of clean hydrogen production in order to obtain the necessary volumes by 2030. OECD countries alone do not have the renewables resources needed to sustain a global renewable hydrogen industry. Various studies suggest 25-30% of all clean hydrogen will be traded internationally, mainly in the form of hydrogen derivatives, by 2050. Therefore, it is necessary to actively support accelerated hydrogen production in Emerging Markets and Developing Countries.

The status of hydrogen projects in Emerging Markets and Developing Countries

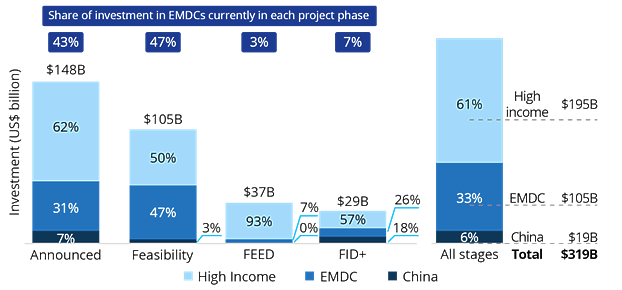

EMDCs account for 35% of the total hydrogen project pipeline in terms of investment volume. However, projects in these countries are concentrated in the early announcement and pre-feasibility study stages. Clean hydrogen projects in EMDCs lag in the more advanced Frond -End Engineering and Design (FEED) and Final Investment Decision (FID) stages. These two more advanced project phases account for only 10% of the project pipeline investment volume, of which 7% represents FEED and 3% FID.

Figure 1. Breakdown of the Global Clean Hydrogen Project Pipeline by Country Group and Project Phase Through 2030 (In US$ billion) / SOURCE: Hydrogen Council (2023); McKinsey (2023). Note: Investment numbers exclude the renewable power component. FID+ refers to any project at or beyond the FID stage.

Across EMDCs, there are only five renewable hydrogen projects outside China of more than 10 MW, three of which have an electrolyser capacity of more than 100 MW. From the total pool of renewable hydrogen projects in EMDCs outside China, only three are in a post-FID stage, with an investment volume of more than US$100 million, and will be operational by 2030. These are NEOM in Saudi Arabia (2 GW electrolyser), a green ammonia plant in Ba Tri, Vietnam (240 MW electrolyser), and the Greenko green ammonia plant in Una, India (140 MW electrolyser).

China has an important program of its own. For example, in July 2023, Sinopec’s Kuqa Plant came into operation with a capacity of 260 megawatts (MW) and 20 kilotonnes (kt) per year but is reported to face operational challenges. Moreover, Energy China’s largest renewable hydrogen project in Songyuan— a US$4 billion, 640 MW ammonia/methanol facility—has broken ground. Adding China to the equation, puts the total EMDC electrolyser capacity with FID at 3.73 GW.

Existing financial support for EMDC hydrogen projects

International financing is available to support hydrogen investments in EMDCs, including concessional and climate funds. For instance, H2 Global has 900 million Euros for its phase 1, additional German funding is foreseen and the Government of the Netherlands has recently announced a 300 million Euro contribution. Furthermore, Germany has recently confirmed a contribution of 434 million Euros to the European Investment Bank’s Green Hydrogen Fund to provide grants to developing countries.

So, there is some funding available for projects in EMDCs, but these funds are comparatively small to the investment gap of $100 billion per year until 2030. Some private sector parties are moving ahead, notably shipping companies such as- Maersk and CMB -, steel makers – such as Vale- or fertiliser companies – such as OCP or Fertiglobe – that identify a need and a competitive advantage in deploying clean hydrogen and its derivatives early on.

OECD countries have announced massive subsidies for clean hydrogen production with the purpose of kick-starting this new industry and “buying down” these technologies. Developing countries cannot match those incentives. Consequently, some project developers are delaying their activity in EMDCs in favour of locations with subsidies in high-income countries.

The barriers for hydrogen project development in EMDCs

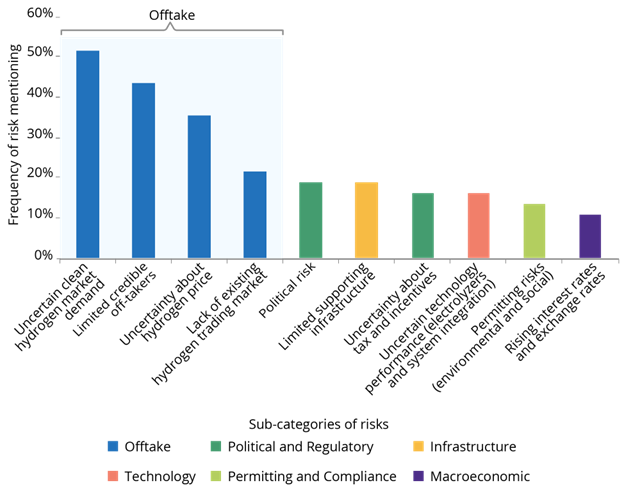

There is a need to understand better why projects in EMDCs are stuck. As outlined in the World Bank’s ESMAP report “Scaling Hydrogen Financing for Development,” key stakeholders around the globe identify six sub-categories of risks, that, if mitigated, would enable the availability of finance: (i) offtake, (ii) political and regulatory, (iii) infrastructure, (iv) technology, (v) permitting and compliance and (iv) macroeconomic risks.

Figure 2. Top Risks in EMDCs that, if Mitigated, Would Enable Clean Hydrogen Projects to Secure Financing / SOURCE: Authors’ estimates

Some of these risks are specific to hydrogen projects, while others relate to general challenges for EMDC investments. It is worth highlighting that the high capital intensity for projects was mentioned as a main barrier by developers. Even the initial stages can be very costly: FEED studies for over 100 MW hydrogen projects can cost in excess of US$ 100 million. Not surprisingly, the higher the perceived risk, the higher the cost of financing and the higher the cost of produced clean hydrogen. Therefore, support programs must assess the relevance of risks in a specific project context and tailor the support to tackle the most relevant risks, in order to reduce the cost of financing and attract public and private financiers.

Reducing risks: the World Bank Group approach

The World Bank approved two hydrogen loans in the course of 2024. One loan for Chile, totaling US$150 million to provide a concessional credit line to finance the electrolyser plant and two reserve accounts that can be tapped in case the electrolysers face operational problems. A second loan of US$1.5 billion for India. The money will offer offtake support (industrial carbon pricing), hydrogen production support (including electrolyser manufacturing), and advance renewable power production. A second loan for India is in preparation. In addition, a large support program of US$1 billion for Brazil was announced at COP28 that focuses on the enabling infrastructure, starting with the Pecem harbor in Ceará. These are examples of three lending programs that tackle offtake, infrastructure, and hydrogen technology risks. Moreover, these de-risking instruments are supplemented by well-established Multilateral Investment Guarantee Agency (MIGA) mechanisms focused on tackling macroeconomic and political risks.

These government support activities are supplemented with private sector focused feasibility study stage funding as well as equity and debt financing from the International Finance Corporation (IFC) and risk mitigation instruments issued by MIGA. IFC is already supporting approximately 10 private sector green hydrogen projects globally, including projects in Poland, Morocco, Chile, Barbados, India, and Brazil.

The 10 GW lighthouse initiative

As part of the ESMAP report, the World Bank Group proposed a 10 GW lighthouse initiative. Its objective is to boost the clean hydrogen industry in EMDCs by getting more projects to FID by 2030. This initiative serves several purposes:

- To develop standardised hydrogen project solutions that are replicable (i.e., technical, spatial, financial aspects).

- To reduce risk so the cost of financing can be lowered.

- To showcase technology readiness and systems integration.

- To develop the full hydrogen chain including production, hydrogen infrastructure and end use.

- To properly monitor and evaluate the projects and make the findings public (“lighthouses”).

- To allocate risks to the most suitable actor.

The initiative focuses on supporting a limited number of projects in the 100 MW to 1 GW scale. There will be no single “true” project model, as there are ammonia, methanol, green steel and jet fuel projects, each with their own characteristics. Moreover, the geographical layout, technology choice, and level of vertical integration will vary. Hence, it is critical to understand the strengths and weaknesses of different project designs. Projects from the existing pipeline will be identified across different EMDCs that can be brought to FID by 2026 with limited and targeted additional effort.

The ultimate goal is to mobilise an additional US$ 10 billion in concessional funding from Development Financing Institutions and Financial Intermediary Facilities to support clean hydrogen projects that will bring sustainable economic and social development to EMDCs. As a result, the 10 GW lighthouse initiative will help to ensure that developing countries can participate in the growing hydrogen economy across the value chain in support of their climate and energy goals.

***

Carolina Lopez Rocha is a Consultant at the World Bank Group

Dolf Gielen is a Senior Energy Economist at the World Bank Group

Ignacio de Calonje is Chief Investment Officer – Energy, Green Hydrogen, Metals & Mining at the IFC (International Finance Corporation)

REFERENCES:

- For the World Bank, “clean hydrogen” includes hydrogen produced from fossil fuels coupled with carbon dioxide capture and storage (combustion based) or carbon storage (pyrolysis based). These are also known as low carbon hydrogen or “blue hydrogen.” Hydrogen produced from water electrolysis using renewable electricity or from biomass is known as renewable hydrogen or “green hydrogen.” “Conventional hydrogen” refers to fossil fuel-based production without carbon dioxide capture and storage. ↑