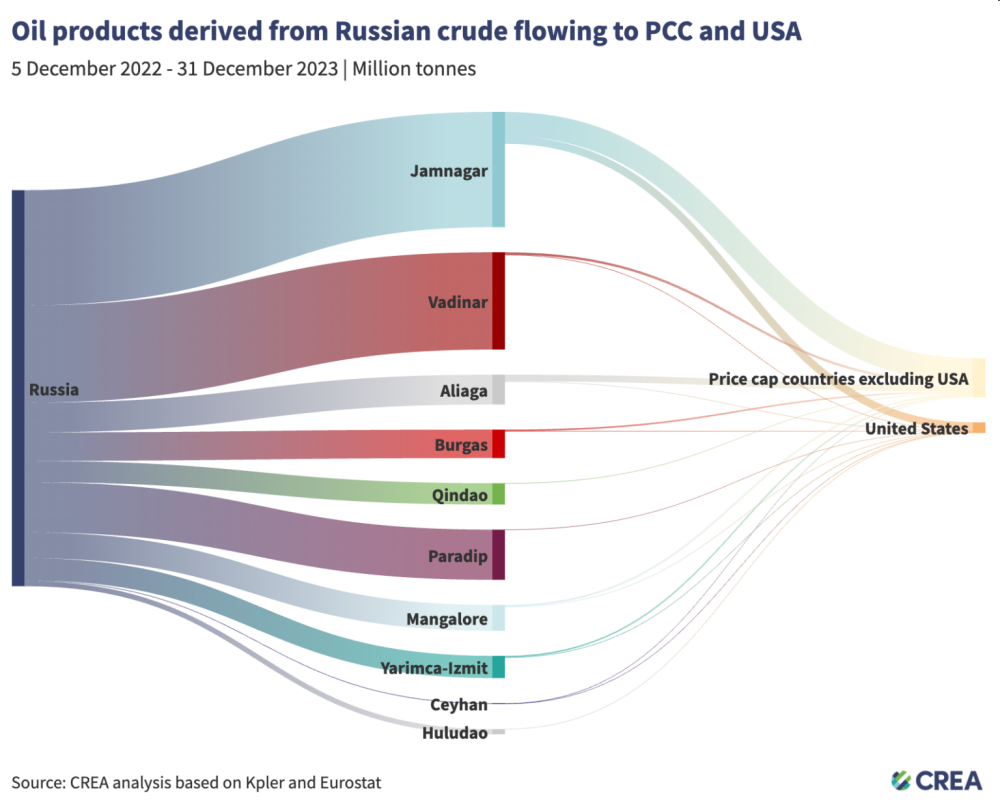

There is a loophole in the sanctions imposed by EU/G7 countries that prohibit the importation of Russian crude oil and oil products. Third countries not imposing sanctions can import Russian crude, refine it into oil products and legally export them to price cap coalition countries (PCC). An analysis by CREA reveals that €8.5bn of PCC imports of oil products in the 13 months to the end of 2023 were made from Russian crude. Also, in 2023, there was a 44% year-on-year increase in PCC imports of oil products, by volume, produced from Russian crude. CREA says the PCC should ban the importation of oil products produced from Russian crude oil. Such a ban would have no significant inflationary pressure because Russia accounts for only 3% of total imported oil products. And to clamp down on illegal and fraudulent imports, more must be done around monitoring and enforcement. Finally, Russia’s export revenues can be cut further by driving down the oil price cap to $30/barrel: if this had been done in December 2022 Russia’s oil export earnings would have been reduced by 25%, or €37 bn, says the CREA analysis.

There is a loophole in the sanctions imposed by EU/G7 countries that prohibit the importation of Russian crude oil and oil products. Third countries not imposing sanctions can import Russian crude, refine it into oil products and legally export them to price cap coalition countries (PCC). An analysis by CREA reveals that €8.5bn of PCC imports of oil products in the 13 months to the end of 2023 were made from Russian crude. Also, in 2023, there was a 44% year-on-year increase in PCC imports of oil products, by volume, produced from Russian crude. CREA says the PCC should ban the importation of oil products produced from Russian crude oil. Such a ban would have no significant inflationary pressure because Russia accounts for only 3% of total imported oil products. And to clamp down on illegal and fraudulent imports, more must be done around monitoring and enforcement. Finally, Russia’s export revenues can be cut further by driving down the oil price cap to $30/barrel: if this had been done in December 2022 Russia’s oil export earnings would have been reduced by 25%, or €37 bn, says the CREA analysis.

The loophole

Sanctions imposed by EU/G7 countries prohibit the importation of Russian crude oil and oil products. The lack of a policy on refined oil produced from Russian crude has meant that third countries not imposing sanctions can import Russian crude, refine them into oil products and legally export them to price cap coalition countries (PCC). This major loophole has helped stabilise the price of Russian crude and ensured that extortionate revenues keep flowing back to the Kremlin.

€8.5bn imported legally from Russia

This CREA analysis has found that in 2023, there was a 44% year-on-year increase in sanctioning countries’ imports of oil products, by volume, estimated as being produced from Russian crude. The analysis shows that EUR 8.5 bn of price cap coalition countries’ imports of oil products between December 2022 and December 2023, were made from Russian crude. These imports in a 13 month period are equivalent to 68% of the EU’s annual commitment to aid Ukraine between 2024 and the end of 2027.

Key findings

- EUR 8.5 bn of price cap coalition countries’ imports of oil products between December 2022 and December 2023, were made from Russian crude. These imports in a 13 month period are equivalent to 68% of the EU’s annual commitment to aid Ukraine between 2024 and the end of 2027.

- In 2023, there was a 44% year-on-year increase in sanctioning countries’ imports of oil products, by volume, produced from Russian crude.

- The price cap coalition’s (PCC) imports of oil products made from Russian crude oil generated EUR 1.7 bn of tax revenues for the Kremlin from December 2022 to December 2023.

- Since the introduction of the price cap till December 2023, the USA imported EUR 1.6 bn worth of oil products derived from Russian crude. EUR 807 mn of Russian crude was used to make these products for the USA.

- Price cap coalition countries imported EUR 2.4 bn of diesel derived from Russian crude.

Next steps

- The most effective step would be to ban the importation of oil products produced from Russian crude oil. This would enhance the impact of the sanctions by disincentivising third countries from importing large amounts of Russian crude and help cut Russian revenues. The price cap coalition’s relatively low reliance (3%) on oil products produced from Russian crude means that a ban on these imports would have no significant inflationary pressure on domestic oil prices.

- The movement towards the implementation of tighter shipping measures are encouraging, but more needs to be done to tackle violations and disincentivise those doing so. The price cap coalition should require maritime insurers to verify via bank statement that the oil price was paid below the cap to avoid fraudulent attestation documents being used to attain Western insurance; this could significantly improve compliance with the policy.

- Vessels owned or insured by G7 countries have persisted in loading Russian oil at all ports within Russia during periods when prices remain above the price cap. These occurrences serve as compelling evidence of violations against the price cap policy. Yet there is very little information on enforcement agencies implementing penalties against shippers, insurers or vessel owners in the public domain.

- The most important way to cut Russia’s export revenues though will be to drive down the oil price cap and use their reliance on G7/EU insurance to do so. Lowering the price cap would be deflationary, reducing Russia’s oil export prices and inducing more production from Russia to make up for the drop in revenue. A price cap of USD 30 per barrel would have slashed Russia’s revenues by EUR 2.65 bn or 24% in December 2023 alone. If this price cap had been established in December 2022, when the sanctions were originally implemented, Russia’s oil export earnings would have been reduced by 25% (EUR 37 bn).

***

This analysis is published with permission from the Centre for Research in Energy and Clean Air (CREA)