The decarbonisation of any sector requires not just the right technologies and processes, but the right monitoring of where the emissions are in the supply chain. That monitoring allows the producer to focus on where the main problems are. It also allows buyers and investors to know what’s really happening, and use their power to demand a low emission product. Nicole Labutong and Wenjuan Liu at RMI look at the quality of the monitoring of the supply chain in the aluminium sector. Aluminium’s emissions must drop by 77% by 2050 to meet global targets. Switching from coal-fired to clean power is an obvious step. What’s particularly interesting is that aluminium is almost endlessly recyclable, which gives the sector an opportunity to cut emissions that most others don’t. Hence the importance of measuring all inputs. One thing is clear, that recycling rates must rise dramatically: even in wealthy Europe roughly 28% of beverage cans still end up in landfills or incinerators. RMI have published guidance on reporting precisely where emissions are coming from in the supply chain. Targets have little meaning and are unlikely to be reached if monitoring is not robust and transparent, say the authors.

The decarbonisation of any sector requires not just the right technologies and processes, but the right monitoring of where the emissions are in the supply chain. That monitoring allows the producer to focus on where the main problems are. It also allows buyers and investors to know what’s really happening, and use their power to demand a low emission product. Nicole Labutong and Wenjuan Liu at RMI look at the quality of the monitoring of the supply chain in the aluminium sector. Aluminium’s emissions must drop by 77% by 2050 to meet global targets. Switching from coal-fired to clean power is an obvious step. What’s particularly interesting is that aluminium is almost endlessly recyclable, which gives the sector an opportunity to cut emissions that most others don’t. Hence the importance of measuring all inputs. One thing is clear, that recycling rates must rise dramatically: even in wealthy Europe roughly 28% of beverage cans still end up in landfills or incinerators. RMI have published guidance on reporting precisely where emissions are coming from in the supply chain. Targets have little meaning and are unlikely to be reached if monitoring is not robust and transparent, say the authors.

Aluminium’s emissions must drop by 77% by 2050

You might know aluminium from the cans you throw in the recycling after a party, but the metal is not just essential to the beverage industry. Aluminium’s lightweight yet strong properties make it indispensable to a range of industries, from cars to airplanes to solar panels.

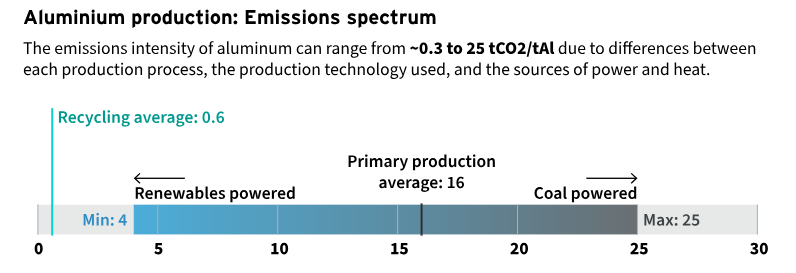

But that versatility comes at a cost. The aluminium industry is responsible for roughly 2 percent of global greenhouse gas (GHG) emissions. The vast majority of those emissions come from producing the metal from bauxite ore using coal-fired electricity (China, the world’s largest aluminium producer at 55 percent of global production, is also emissions-intensive). But aluminium’s reliance on electricity makes it ripe for rethinking and charting a path toward a renewables-powered future.

CHART: RMI / DATA : International Aluminium

And that can’t come at a moment too soon: aluminium’s centrality to the energy transition is poised to increase consumption by between 50 and 80 percent by 2050, all while aluminium’s emissions need to drop by 77 percent to stay within a 1.5°C pathway.

Endlessly recyclable

Of course, the most climate-friendly aluminium is produced using the least energy, and that’s where the metal has a distinct advantage. Endlessly recyclable, aluminium that is reused has a much smaller carbon impact. However, recycling will not decarbonise the sector alone as scrap is not enough to meet the growing demand for aluminium.

So in order for this essential industry to thrive in a net-zero world we need two things to happen: aluminium production from raw materials must switch to renewable sources, and recycling rates need to increase dramatically.

RMI is focused on solving both of these challenges simultaneously by working directly with both aluminium producers to increase transparency in their processes as well as the financial institutions that will need to finance nearly $1 trillion in additional investment required to transition the sector to renewable energy and reach net zero by 2050.

Getting granular on recycling

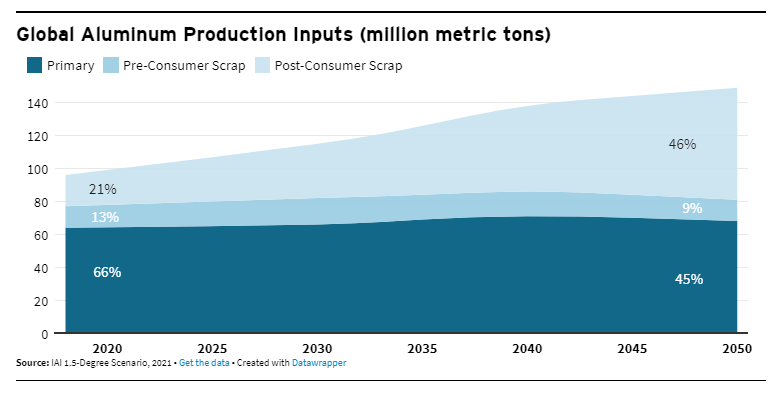

Not all recycled aluminium is equal. In order to decarbonise the aluminium sector, it’s important to separate out post-consumer aluminium (i.e., your empty soda can) from pre-consumer aluminium (the wasted ends of aluminium sheeting on the can’s factory floor). The industry term for these “waste” products is scrap.

SOURCE: IAI 1.5-Degree Scenario, 2021 / Get the data Created with Datawrapper

On the pre-consumer side, to reach net zero, manufacturing needs to become more efficient so that extra aluminium isn’t produced in the first place. Although this is eventually recycled, we must reduce this pre-consumer scrap from 13 percent to 9 percent of production by 2050 to reach net zero.

On the post-consumer side, much more can be done. A European study found that roughly 28 percent of beverage cans on the continent end up in landfills or incinerators. On a global scale, the use of post-consumer scrap in aluminium production needs to jump from 21 percent to 46 percent by 2050 to stay in line with net-zero goals.

RMI is helping speed this process along with the urgency it requires by working with aluminium producers to increase transparency for aluminium buyers.

To incentivise the use of more post-consumer scrap, it is important to know what percentage of an aluminium product’s inputs are from this end-of-life scrap. Currently, most aluminium producers just report the total recycled content in their aluminium products, making it impossible to know whether or how much post-consumer scrap was used. To overcome this challenge, buyers of aluminium products are increasingly requesting more information on the share of post-consumer scrap in their purchased products.

RMI’s Aluminium GHG Emissions Reporting Guidance encourages separate disclosure of the different types of scrap aluminium that get made into end products — incentivising buyers to support the kinds of recycling we need.

Better reporting, better outcomes

The guidance doesn’t stop at recycling however, it also enables producers to account for and disclose the emissions intensity of their products — gaining a competitive advantage in meeting corporate buyer demand for emissions transparency.

RMI aims to match sustainable aluminium supply and demand by making it possible to report precisely where emissions are coming from in the supply chain. This precision equips banks and other financial institutions with the information they need to direct capital to low- or zero-carbon emissions aluminium technologies and projects, it also empowers corporate buyers with the information they need to make procurement decisions to drive demand for low-carbon aluminium.

The road ahead

Equipping aluminium producers with the tools they need to transition to net-zero production will take vast amounts of capital, as well as a renewed focus on recycling. RMI is working up and down the aluminium value chain to advance these goals in this critical decade. Learn more about our work with aluminium.

***

Nicole Labutong is a Principal, Climate Intelligence at RMI

Wenjuan Liu is a Senior Associate, Climate Intelligence at RMI

This article was first published on RMI.org, and has been reprinted with permission