There is a danger that the U.S. Inflation Reduction Act (IRA) subsidies for hydrogen production (defined in provision 45V) may create perverse incentives that do not reduce emissions and may increase them. James Sallee at the Energy Institute at Haas explains why. The goal is to make “green” hydrogen powered by newly built clean energy. But what if the generously subsidised hydrogen is made from clean energy (new or not) that should be powering something else (something not so well subsidised)? Something else that lowers emissions better? Sallee takes a look at how it might happen, including a best-case scenario at a proposed plant in Texas. Sallee believes pricing emissions is almost always better than using subsidies, but accepts the reality of politics makes the latter easier to enact. Hence, Washington will need to create hydrogen policy that ensures emissions across the whole system go down, and directs hydrogen into the right industrial and transportation applications. And it’s not just about the emissions, it’s also about the money: should government targets be met, the hydrogen subsidies amount to $30bn per year by 2030, which exceeds the pre-IRA subsidies for wind, solar, and EVs combined.

There is a danger that the U.S. Inflation Reduction Act (IRA) subsidies for hydrogen production (defined in provision 45V) may create perverse incentives that do not reduce emissions and may increase them. James Sallee at the Energy Institute at Haas explains why. The goal is to make “green” hydrogen powered by newly built clean energy. But what if the generously subsidised hydrogen is made from clean energy (new or not) that should be powering something else (something not so well subsidised)? Something else that lowers emissions better? Sallee takes a look at how it might happen, including a best-case scenario at a proposed plant in Texas. Sallee believes pricing emissions is almost always better than using subsidies, but accepts the reality of politics makes the latter easier to enact. Hence, Washington will need to create hydrogen policy that ensures emissions across the whole system go down, and directs hydrogen into the right industrial and transportation applications. And it’s not just about the emissions, it’s also about the money: should government targets be met, the hydrogen subsidies amount to $30bn per year by 2030, which exceeds the pre-IRA subsidies for wind, solar, and EVs combined.

Provision 45V of the Inflation Reduction Act (IRA)

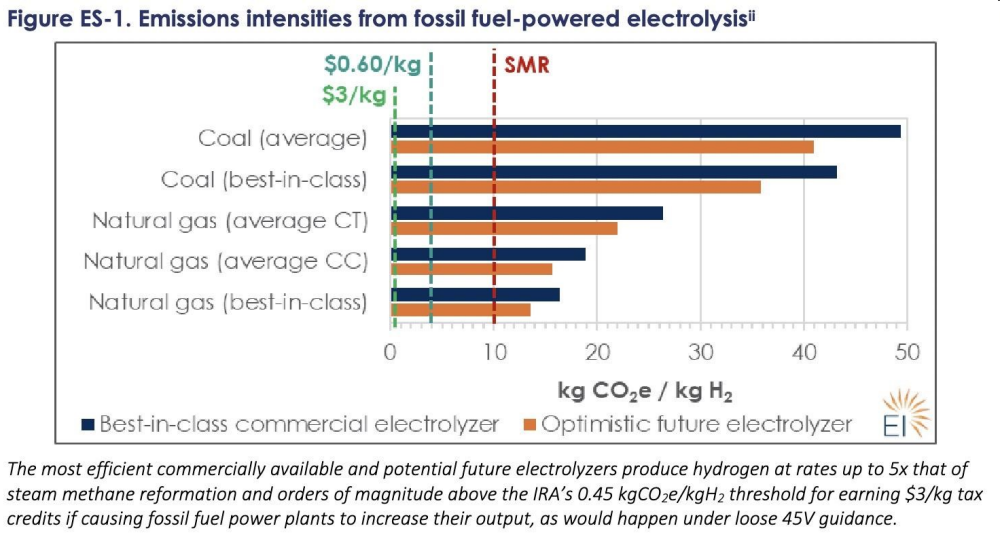

Among the many provisions of the Inflation Reduction Act (IRA) is 45V, which specifies subsidies for the production of low-carbon hydrogen. So-called “green hydrogen” can lower emissions by displacing conventional hydrogen production, which is associated with nearly 3% of global greenhouse gas emissions, but it has even greater potential as a low carbon alternative to fossil fuels in transportation and industry.

Generous subsidies in the IRA top off at $3 per kilogram, which is roughly double the current market price for conventional hydrogen made from natural gas, and is plausibly large enough to drive net costs below zero given projected (though highly uncertain) learning rates. If the industry can hit the Department of Energy’s own production targets, the subsidy would translate to $30 billion in subsidies per year by 2030, which exceeds pre-IRA subsidies for wind, solar, and electric vehicles combined.

Powering H2 production: switching from fossils to clean

The trouble is that hydrogen production might increase emissions in the near term if it turns out to rely on electricity made from fossil fuels. This is possible because measuring the carbon footprint of hydrogen turns out to be quite a challenge. If the Treasury, which is tasked with determining eligibility, makes rules that are too lax, many worry that taxpayers will end up spending billions to pay for the production of H2 that turns out to be a lot of hot air.

It’s not hard to imagine 45V ultimately killing public support for hydrogen by becoming the Solyndra of the IRA—an inflated cudgel for critics of the climate agenda—and simultaneously turning off enough climate hawks to get hydrogen filed alongside nuclear power as a decarbonisation pathway that splits environmental groups.

Unfortunately, getting the tax guidance right is not only critical, but also exceptionally difficult. To see why, we need to start by understanding what green hydrogen is and how the law is written.

What is green hydrogen?

Conventional (grey) hydrogen is produced from natural gas via steam methane reforming (SMR). Green hydrogen comes when hydrogen is pulled out of water via electrolysis powered by clean electricity. (In this post, I am going to focus on electrolysis, but there is another important debate about the use of biogas that warrants its own post.)

The trouble with figuring out if your hydrogen is green is that, while it is straightforward to see whether hydrogen is generated by electrolysis, it is difficult to assign emissions to the power that created it.

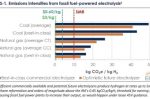

The IRA spells out subsidy tiers that are based on carbon emissions per kg of hydrogen produced, rather than specifying a production process. To get the full $3 per kg production subsidy, emissions need to cause less than 0.45 kg of carbon emissions per kg of hydrogen. This represents a 95% reduction relative to SMR, which accounts for nearly all hydrogen production today. (There are substantial, but less generous, subsidy tiers ending with a $0.6/kg subsidy for production with less than 4 kg of carbon per kg of hydrogen, with a couple of other intermediate values.)

SOURCE: Energy Innovation

Electrolysis is energy-intensive, so even a little bit of emissions per kWh can make electrolysis carbon intensive. This chart, from a study by Energy Innovation, shows the emissions rates for hydrogen made by electrolysis powered by fossil fuels, as they compare to the policy benchmarks and SMR. Electrolysis powered by best-in-class efficient natural gas electricity plants would create emissions roughly 30 times larger than the $3/kg credit target, and coal-powered electrolysis is easily 100 times the standard. Across the board, switching from SMR to electrolysis powered by fossil fuels increases emissions substantially.

The key implication is that if even a small fraction of the power going to a hydrogen plant is associated with fossil generation, then it should push the emissions rates out of the $3/kg tier, and modest use of fossil generation can make H2 from electrolysis dirtier than conventional SMR. This makes it paramount to get the accounting right.

How “carbon laundering” might happen

Any hydrogen facility that draws power from the grid is going to have to use some accounting method to demonstrate that it is running on clean power. The lax version of this is to require facilities to hold renewable energy certificates (RECs) or power purchase agreements (PPAs) that true up on an annual basis to cover their consumption. The problem with this is that RECs and PPAs will often just reshuffle attribution; they do not actually guarantee that new renewable generation was brought online because of the demand from hydrogen. An annual matching criteria can easily lead to a form of “carbon laundering”, where instead of using natural gas directly to make hydrogen through SMR (which is more efficient), natural gas makes electricity that feeds an electrolyser while the operator buys non-additional paper contracts to certify that the electricity, and thus the hydrogen, is green. Emissions go up and producers collect a check from taxpayers.

The IRA will get hydrogen off the ground, but details from Treasury are needed to safeguard against bad outcomes / SOURCE

Advocates of stricter criteria focus on what has come to be called “three pillars” of new construction (often erroneously called “additionality”), deliverability, and hourly matching. In essence, these rules require that projects be able to contract for renewable power that is new, situated in the same part of the grid, and based on time-specific certificates that cover consumption every hour of the year.

Several analyses (discussed here) conclude that, because the $3/kg subsidy is so generous, hydrogen that meets these criteria is cost-competitive with grey hydrogen today. As a result, many environmental groups are urging the Treasury to apply a strict definition of eligibility, arguing that it will avoid perverse outcomes without stifling the industry. This may well be the right course, but unfortunately even the three pillars cannot fully solve the carbon accounting conundrum.

The trouble with subsidies

To an economist, all of this highlights risks that come with using carrots (subsidies) as the primary policy lever, instead of sticks (emissions pricing). It is impossible to definitively prove the additionality of renewable generation associated with a hydrogen project, which means it is impossible to prove that a given project did not cause emissions to go up somewhere. That’s because additionality requires observing a counterfactual. A counterfactual is, by definition, something that did not happen, which makes it hard to observe. To know if a project did or did not cause an increase in emissions across the entire complex electricity grid, one needs to measure and compare emissions with the project (observable) and grid emissions without the project (not observable—must be based on a model or assumptions).

Even “best case” H2 plants are questionable

To see how truly hard this problem is, consider a best-case scenario, like this proposed plant in Texas. It plans to build a hydrogen facility capable of producing 73,000 tons of H2 per year, paired with 1.4 GW of wind and solar capacity to support the facility, which will both power the plant and sell clean power to the grid during hours of excess generation. This one plant stands to earn billions in subsidies from both 45V and renewable energy credits, which it can also claim.

Most view this as a slam dunk—clearly that plant is not creating any new emissions (beyond the life-cycle emissions of the building materials). But this doesn’t have to be true. If this was a good site for wind or solar generation, then those renewables might have come online without the hydrogen facility with the power sold into other uses that clean up the grid. In that case the hydrogen plant is crowding out some other application of clean power and implicitly pushing up demand for fossil generation. And, given interconnection queues and transmission bottlenecks, adding renewables to the grid to support the plant might well prevent or delay other wind or solar resources from coming online.

Don’t use subsidies. Price emissions instead

Energy system modelers have attempted to take account of the existing generation mix plus entry and exit in order to estimate the counterfactuals. But these models have significant uncertainty, and Treasury cannot run them for every plant; instead they will issue more general rules. In contrast to all of this, to create the right incentives for industry when pricing emissions, one only needs to observe what actually happened. It isn’t necessary to model the counterfactual. This is a big advantage of pricing emissions compared to using subsidies.

Create hydrogen policy that directs its use into the right applications

Another problem with subsidies is that they do nothing on their own to direct the hydrogen towards uses that reduce pollution the most. Right now, demand for clean hydrogen in steel, cement, shipping, and trucking is due to scattershot interest for voluntary carbon mitigation and a geographically fragmented set of policies. If we want to make sure hydrogen is directed into the right application, we need another round of policy out of Washington, which is fraught to say the least given electoral politics. Moreover, if we continue to rely on a raft of subsidies and separate regulations, it will be difficult to harmonise abatement costs across sectors.

In contrast, a comprehensive price on carbon emissions would tilt producers towards green (or blue) hydrogen instead of grey, as well as ensuring that demand for hydrogen across industrial and transportation applications is strongest where the alternative abatement costs are most expensive.

Figure shows where hydrogen is used today. Clean hydrogen could displace conventional hydrogen and lower emissions in these sectors, or be used in new industrial and transportation applications. / SOURCE: Breakthrough Energy

Lessons for today and for the future

What should we conclude about today’s question around 45V? Some argue that tight Treasury rules unfairly single out hydrogen. After all, other green subsidies also run the risk of perversely increasing emissions—electric vehicles (aka “external combustion engines”) can increase emissions if they draw from a sufficiently dirty grid, and heat pumps can increase emissions if enough refrigerant leaks. The key difference here seems to be that perverse outcomes are more likely for green hydrogen.

Moreover, the $3/kg subsidy cannot be justified on direct carbon mitigation grounds alone, even if we use a $200 social cost of carbon. The subsidy might be rationalised based on knowledge spillovers, whereby quick adoption now can push industry down a learning curve (though even then the IRA policy window might well be too long). Part of what we want hydrogen producers to learn is how to design plants to run intermittently in harmony with renewable supplies and how to prove as reliably as possible that they are green. If tighter eligibility rules move us closer to that goal, they are likely a good idea for the long run.

What broader lessons does this challenge hold? There is a healthy debate about the best way to design policies for decarbonisation among academics. Economists tend to favour policies that put a price on pollution, while many political scientists and other analysts favour subsidies or industrial policy on political economy grounds. Some view the Inflation Reduction Act, which is basically a giant flotilla of subsidies, as settling the debate: after years of floundering to pass policies that price pollution, a full embrace of the subsidy and industrial policy approach led to a historical bill.

This may well be the case, and it may be that generous subsidies are the best way to quickly ramp the green hydrogen industry. But, reliance on subsidies creates a set of challenges that policymakers and analysts need to understand and to face with eyes wide open.

***

James Sallee is Associate Professor, Department of Agricultural and Resource Economics, University of California, Berkeley, and a Research Associate of the Energy Institute at Haas

This article is published with permission.

Keep up with Energy Institute blogs, research, and events on Twitter @energyathaas