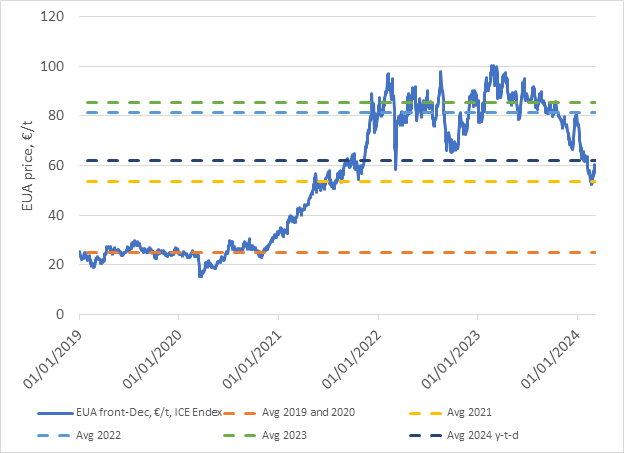

European carbon allowances (EUAs) are trading at around €60/t. One year ago, it was at an all-time high of €100/t. Hæge Fjellheim at Veyt explains why, and why prices should recover. Economically, the drop is due to two main factors: lower gas prices and shrinking energy demand from industry. Politically, additional supply of EUAs came from the EU’s REPowerEU plan to accelerate the energy transition and break dependency on Russian gas by partly financing it from sales of EUAs borrowed from future EU carbon allowance budgets. One problem is the low prices hit a major revenue source for the green transition in Europe. And low prices lessen the pressure on actors to reduce emissions. Fjellheim concludes with Veyt’s forecast that prices will hit €160/t in 2030.

Turning tides for European Carbon

One year ago, the cost of emitting one ton of carbon in Europe reached an all-time high of €100/t. European carbon allowances have recently been trading at close to half of that level and currently linger around €60/t. Lower prices minimise both the appetite to reduce emissions and the funds that will help finance the green transition. But a price recovery is on the cards.

EUA prices 2019-2024 – ever increasing carbon prices year on year, 2024 an outlier so far. / SOURCE: ICE, Veyt

Lower gas prices and shrinking energy demand from industry

Like in any other commodity market, prices respond to changes in supply and demand. In carbon markets, demand is fundamentally guided by emissions – and they are down in the sectors covered by the EU emissions trading system (EU ETS). Substantially so. Power sector emissions decreased 20 percent last year and the decline has continued into 2024. This is due to two main factors: lower gas prices and shrinking energy demand from industry.

The immediate energy crisis has blown over – gas is abundant in Europe, the winter has been mild, storage levels are healthy, and prices are at a tenth of what they were after Russian invasion in Ukraine. This means electricity is produced with lower emissions compared to when coal power plants were running at full speed across Europe. What is more – gas continues to be in the money for electricity production in the foreseeable future.

European industry continues its uphill struggle and worries over the health of the European economy persists. Reduced economic activity means lowered emissions and muted demand for carbon allowances. Operating in a high interest rate environment, carbon market players do not have the financial muscle to take advantage of the slashed carbon prices, and the appetite for allowances remains low.

The politics

Lower demand is married to more allowance supply, resulting in a perfect bearish storm, it turns out. The EUs REPowerEU plan to accelerate the energy transition in Europe and break dependency on Russian gas is partly financed by sales of EUAs borrowed from future EU carbon allowance budgets. With a monetary target of €20 billion to be raised over three years (2023-2026), the amount of carbon allowances put on the market depends on carbon price levels. Lower prices mean that more allowances must be put on the market (that currently does not need them), which has further fuelled a bearish trend. The worry over short-term additional supply could continue to keep carbon prices muted.

When REPowerEU was proposed in May 2022, industry was facing astronomic energy costs – both power and gas prices have decreased around 70 percent since then – and carbon traded at €85/t. While the stated aim of the programme was to speed up decarbonisation, some policymakers were also arguing that the measure would help dampen carbon prices. They are not taking credit for the lowered carbon prices at the moment though. The concern is rather that consistently weakened prices will hit what has become a major revenue source for the green transition in Europe.

Double trouble

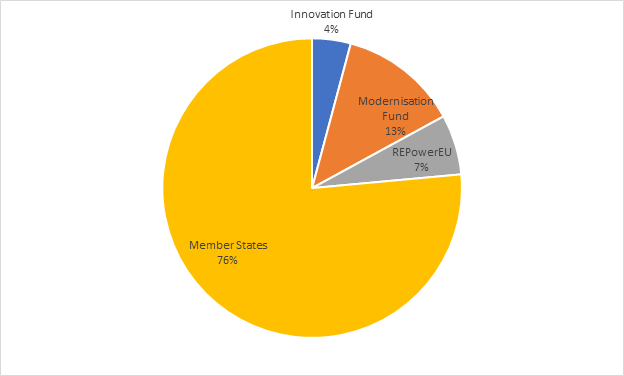

Last year, under a €84/t average carbon auction price, sales of allowances generated nearly €44 billion to EU funding mechanisms and to member state coffers – money that is channelled both to finance the green transition and to buffer the social effects of going from grey to green. Member state revenues, the Innovation Fund, the Modernisation Fund and REPowerEU all suffer from a decline in carbon prices. With year-to-date carbon auction price at €26/t lower than last year’s average, we see a €2.4 billion write-off on all allowance auction revenues combined over the two first months of 2024.

A structurally lower carbon price has two main effects. First, it provides industrial emitters with a sense of comfort that investments in abatement technologies can wait. This will haunt the market in the long-term with an even higher reduction effort required towards 2030 and beyond. A classic ‘kicking the can down the road’ effect. Secondly, it undermines the funding that will be required in the long-term to cross-finance abatement solutions that are required to meet EUs 2030, 2040 and 2050 climate ambitions.

EUA auction revenues 2023 by recipient – member states coffers take the bigger hit from lowered carbon prices. / SOURCE: Veyt

From myopic to bird’s eye view

The tide will turn again. While all price drivers have been pointing south, this will have to change. Gas and carbon prices are set to decouple when a lower gas price cannot incentivise more fuel switch. This is similar to the situation during the energy crisis when gas prices continued to climb while carbon prices stabilised as even higher gas prices did not result in any additional emission reductions. This could happen within weeks.

Over time, the stark realities of a tighter fundamental market balance will sink in. Come 2027, there will be no further additional allowances put on the market to finance REPowerEU. Combined with an ever-declining cap to ensure the EUs 2030 climate target is met, annual allowance auction supply is also reduced due to the missing volumes that were lent to finance the decarbonisation programme. Finally, the system’s market stabilisation mechanism will treat the REPowerEU volumes as a ‘supply shock’, holding back more allowances from the auctions and keeping them out of market circulation.

It is a blueprint of how the market will look like in the future: with a cap destined to reach zero before 2040, the room for emissions from the big polluters is narrowing very fast. And carbon prices will have to reflect the increasing cost of reducing emissions: Veyt forecasts prices to hit €160/t in 2030. Predicting the exact point in time and price level when the market dynamics will shift from myopic to farsighted is difficult. One thing is clear, though, that every delayed investment into abatement technology and emission reduction measures today will add to a bullish market environment towards 2030 and beyond. The earlier the market sees through the fog, the earlier the carbon price will re-align with the mid-to long-term fundamental picture.

***

Hæge Fjellheim is Head of Carbon Analysis at Veyt