Interconnectors allow for cross-border flows of energy between two markets that would otherwise not be connected. Through an economic convergence between supply and demand, the cheapest marginal producer located anywhere in these two markets should be able to set market prices. As Jean-Baptiste Vaujour at the Emlyon Business School explains, the central question is to find an optimal allocation of the scarce interconnection capacity between the various suppliers and customers in both markets, allocated over different time horizons (from intra-day to months). It’s why the Joint Allocation Office (JAO) was set up in 2015, a centralised body to deal with the increasing complexity of the coupling of European markets. It organises more than 20,000 auctions per year, serving more than 430 market participants across 41 European bidding zones. Vaujour describes the challenges and how the JAO is meeting them, noting that its importance is bound to increase with time.

Interconnectors allow for cross-border flows of energy between two markets that would otherwise not be connected. Through an economic convergence between supply and demand, the cheapest marginal producer located anywhere in these two markets should be able to set market prices. As Jean-Baptiste Vaujour at the Emlyon Business School explains, the central question is to find an optimal allocation of the scarce interconnection capacity between the various suppliers and customers in both markets, allocated over different time horizons (from intra-day to months). It’s why the Joint Allocation Office (JAO) was set up in 2015, a centralised body to deal with the increasing complexity of the coupling of European markets. It organises more than 20,000 auctions per year, serving more than 430 market participants across 41 European bidding zones. Vaujour describes the challenges and how the JAO is meeting them, noting that its importance is bound to increase with time.

This article is the final in a series of four articles by Vaujour dedicated to the development of electrical interconnectors in Europe. The first article discusses the economics of interconnectors and their important contribution to security of supply, electricity affordability and emissions reduction in Europe. The second looks at Eleclink, an innovative private interconnector. The third looks at how they are financed. Vaujour is also planning a follow-up article, written in tandem with people from the industry.

Understanding scarcity management and congestion revenues

Interconnectors allow for cross-border physical flows of energy between two markets that would otherwise not be connected. They thus enable an economic convergence between supply and demand between these two markets and the cheapest marginal producer located anywhere in these two markets will be theoretically setting market prices.

However, the amount of energy that can flow in either direction at any given time is limited by the physical capacity of the cable. This is one of the reasons interconnectors are significantly bigger than traditional transmission lines and are using direct current: it allows them to have a very high capacity, often around or above 1,000 MW. To provide some sense of scale, this level of capacity is comparable to some of the biggest nuclear power plants. When the maximum capacity of the interconnector is reached, additional power flows between the two markets become impossible and prices start diverging as customers in the market experiencing a shortness in supply will turn towards more expensive means of production, i.e. move up the merit order curve[1].

In economic terms, the central question is then to find an optimal allocation of the scarce interconnection capacity between the various suppliers and customers in both markets. That capacity can be allocated over different time horizons, such as multiple months ahead, one month ahead, a week ahead, a day ahead or even intra-day. At any given time, the current flowing on the interconnector is thus the result of a complex contractual and economic composition.

The owners of the interconnectors are legally unbundled from all market participants, which means that in application of European law, they cannot have any interest in the market equilibrium on either production or consumption sides. As a corollary to this, they will seek to indiscriminately extract value from the use of the interconnectors by market participants in order to cover the investment and operational costs.

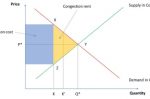

SOURCE: Author simplified representation, based on Joskow, Tirole, Merchant Transmission Investment, The Journal of Industrial Economics, 2005 (source). In this graph, two countries E and S are interconnected. Q* and P* represent the situation where there is no restriction on interconnection capacity. A market equilibrium is reached and prices converge on both sides. Now if a maximum transmission capacity K is introduced, quantities produced in country E are reduced and prices are higher in Country S (points X and Z). The XYZ triangle represents the congestion rent and the blue square is congestion cost.

An allocation problem – how to extract the socially optimum price for scarcity

On a closed market, participants on wholesale power markets take positions according to their anticipations as to the future state of the merit-order curve at any given time. It involves complex estimates of demand, production capacity and outside variables such as the weather or special events. When interconnectors come into play, they have to add a layer of complexity as they have to anticipate the evolution of supply and demand on both sides of the border and to factor in the availability of the interconnectors. From these calculations, they can then derive a maximal price they are ready to pay in order to reserve in advance that capacity. Together, through an iterative process, they will decide on a market-based optimum pricing.

The interconnectors on the other hand do not have a monopoly power as they are in competition with alternative means of production. They cannot enforce unilateral prices on their users, otherwise they would lose customers to, for example, peaking power plants.

In practice, there are three value drivers that can be isolated for the interconnection rent[2]. The average price difference between the two countries is the basis of the value. Volatility in prices increases the value of the rent as market participants will be more likely to book capacity if they expect important fluctuations. The lack of correlation between prices in the two countries is the final driver: all things being equal, a high degree of correlation between prices reduces the need for interconnectors as market participants have less arbitrage opportunities. In a system where renewables play an increasing part, this last variable is bound to become critical and weather patterns across Europe will play a significant role in interconnection pricing. The whole point is then to benefit from differences between meteorological areas and to connect markets across multiple borders, for example the North Sea area (wind risk) with the Mediterranean area (sun risk).

Power contracts can be negotiated over-the-counter between significant market participants and these contracts are most of the time long-term contracts. The current development in Corporate Power Purchase Agreements (CPPAs) is feeding that trend. When these contracts are cross-border (for example an industrial producer in Germany would purchase power in France), they have to book interconnector capacity as well as the contracted volume. However, a very significant part of traded volumes are exchanged on power exchanges in Europe through national and transnational contracts. It became very impractical and sub-optimal in terms of pricing to have a first transaction on power markets and then a second bilateral transaction with the individual interconnector. The increasing coupling of European markets required the emergence of a centralised solution to solve this issue.

The role of the Joint Allocation Office (JAO)

JAO was set up in 2015 from the merger of previously initiatives created by regional TSOs and has been recognised as the Single Allocation Platform for all TSOs that operate according to EU law in 2018. It has become the institutional answer to the capacity allocation problem at continental scale.

It creates the market place for the competitive emergence of a price for the interconnection capacity at various points in time. In order to do this, it organises more than 20,000 auctions per year, serving more than 430 market participants across 41 European bidding zones. Auctions are the best way to allocate capacity to the actor that can extract the most value from the use of the interconnector, in other words to flag capacity towards the greatest economic need.

…Explicit auctions

Explicit auctions are auctions that are separated from the electricity transaction itself. Capacity is auctioned in blocks through annual, monthly or daily auctions. These auctions are governed by the European Harmonised Allocation Rules (EU-HAR) published by ACER and they are organised by JAO. This organisation has the benefit of simplicity. However, the fact that the power and capacity transactions are not joined creates inefficiencies as there is a lack of information on the other leg of the deal when passing the order[3]. This leads to the rise of a secondary market where capacity can be traded between market participants as long as they inform the interconnection company.

…Implicit auctions

Day-ahead and intraday markets are organised differently, through implicit auctions. In order to enable market coupling, capacity is directly allocated through the purchase/sell order on the electricity market. The potential price difference between market zones implicitly reflects the cost of congestion and provides a financial incentive to export (import) electricity towards the more expensive (from the cheaper) zone. An algorithm called Euphemia has been introduced to allow for the coupling of day-ahead markets (Single Day-Ahead Coupling – SDAC) and intraday auctions should be going live in June 2024 (Single Intra-Day Coupling – SIDC). JAO for its part provides shadow auctions that act as a back-up for SDAC[4].

JAO also provides a series of ancillary services such as clearing and settlement, as well as contracting, reporting and support services4.

JAO is already at the centre of European power markets both de facto and de jure. With the development of interconnections notably as a way to hedge against meteorological variability and intermittency, its importance is bound to increase with time.

***

Jean-Baptiste Vaujour is Professor of Practice at the Emlyon Business School

NOTES:

- The merit-order curve ranks all available means of production at a given time according to their marginal production cost. The last power plant whose production is purchased sets the market price. ↑

- Source : Eleclink, Shedding some light on a key European project, Altermind, 2019, page 43. ↑

- Source : NordPool ↑

- Source : JAO official website

This article is also based on publications from RTE (source) and Elia (source) ↑