2024 should see a further acceleration in steel’s transition away from coal, with increasing pressure on companies in the value chain to act on their Scope 3 (indirect) emissions, explains Simon Nicholas at IEEFA. Old coal-fired blast furnaces that use low-grade iron ore are already being replaced with the direct reduced iron (DRI) process in Europe and China. That means the “big four” iron ore miners have to ramp up production of high-grade iron to supply them. Vale, Rio Tinto and Fortescue are focusing on higher-grade ores compatible with green hydrogen-based production of DRI. BHP meanwhile is putting its faith in CCUS, despite carbon capture’s very slow progress in delivering results. Part of the solution will also likely be technology combinations that allow the use of lower-grade ore in DRI-based steelmaking, says Nicholas. Whatever happens, the transition is underway with billions being invested.

2024 should see a further acceleration in steel’s transition away from coal, with increasing pressure on companies in the value chain to act on their Scope 3 (indirect) emissions, explains Simon Nicholas at IEEFA. Old coal-fired blast furnaces that use low-grade iron ore are already being replaced with the direct reduced iron (DRI) process in Europe and China. That means the “big four” iron ore miners have to ramp up production of high-grade iron to supply them. Vale, Rio Tinto and Fortescue are focusing on higher-grade ores compatible with green hydrogen-based production of DRI. BHP meanwhile is putting its faith in CCUS, despite carbon capture’s very slow progress in delivering results. Part of the solution will also likely be technology combinations that allow the use of lower-grade ore in DRI-based steelmaking, says Nicholas. Whatever happens, the transition is underway with billions being invested.

Key Findings

- The growing decarbonisation of steel production is prompting differing strategic responses from leading global iron ore miners.

- Of the four major producers, three – Vale, Rio Tinto and Fortescue – are increasingly focusing on higher-grade ores that are compatible with green hydrogen-based production of direct reduced iron (DRI).

- BHP meanwhile continues to put its faith in carbon capture, utilisation and storage (CCUS), despite the technology’s longstanding record of underperformance.

- As the steel technology transition away from coal accelerates, and pressure grows for companies to address Scope 3 emissions, solutions that support DRI-based steelmaking seem more likely to play a key role than CCUS.

Responsibility for Scope 3 emissions

Growing steel decarbonisation momentum is prompting three of the big four iron ore miners to increase supply of high-grade iron ore. The other is more focused on floundering carbon capture technology, while investor pressure on Scope 3 emissions continues to build.

Much of the focus on the outlook for iron ore naturally emphasises shorter-term economic performance and steel demand in China – by far the largest importer of iron ore globally. China is the destination for 85% of Australia’s iron ore exports.

Green hydrogen-based DRI around the world

However, along with declining long-term steel demand and plans for increased recycling of scrap steel, there is another trend emerging in China. In January 2024, it was announced that China Baowu – the world’s largest steelmaker – has begun commercial-scale production of direct reduced iron (DRI) in Guangdong province. Using Energiron technology, the plant has been built hydrogen-ready.

Green hydrogen-based DRI has emerged globally as a key technology to reduce primary steelmaking emissions, which also constitute the great majority of iron ore miners’ Scope 3 emissions. However, DRI production requires a higher grade of iron ore with a greater iron (Fe) content than that used in coal-consuming blast furnaces. Direct reduction (DR)-grade ore has an Fe content of 67% or more. A global steel industry shift from blast furnaces towards DRI will drive a significant shift in the quality profile of traded iron ore.

China Baowu’s project is the second commercial-scale Energiron DRI plant to begin operations in China, after HBIS started production at its plant in 2023. China is targeting peak steel sector emissions by 2030 but looks like it is well ahead of schedule.

The emergence of commercial-scale DRI production in China mirrors European steelmakers’ growing shift towards technology that doesn’t use coal and is already hydrogen-ready.

Meanwhile, Asian steelmakers including Japan’s Kobe Steel and JFE Steel are targeting DRI production in the Middle East, which is already an established user of mature DRI technology.

Australia’s iron ore miners

The global steel technology shift away from blast furnaces is accelerating and demand for suitable iron ore is set for significant growth. DR-grade ore makes up only a small fraction of overall iron ore trade, and Australian iron ore miners have long focused on lower-iron content, blast furnace-grade ore in response to the huge growth in blast furnace-based steel production in China over the previous two decades.

The benchmark 62% Fe iron ore produced in the Pilbara is not suitable for existing DRI processes and the quality being produced in the last decade has been falling, making it even less suitable.

Part of the solution will likely be technology combinations that allow the use of blast furnace-grade ore in DRI-based steelmaking. In Germany, Thyssenkrupp is starting to progressively replace its blast furnaces with DRI shaft furnaces plus a melting stage, which then feeds existing basic oxygen furnaces, allowing it to continue using lower-grade ore. All three of the Australian iron ore majors are developing DRI-based technology combinations that can use blast furnace-grade, Pilbara iron ore.

However, where steelmakers switch from blast furnaces and basic oxygen furnaces to the established and mature DRI-electric arc furnace (EAF) steelmaking pathway, DR-grade iron ore will be required.

The leading global producer of DR-grade iron ore – Brazil’s Vale – is planning to increase its supply of the high-grade ore in response to the accelerating steel technology shift. The remainder of the ‘big four’ iron ore producers, operating in Australia, are now demonstrating differing responses to this trend.

Rio Tinto

Rio Tinto’s Canadian operations already produce DR-grade iron ore, and Rio has signed a multi-year agreement to supply the product to Swedish steel start-up H2 Green Steel.

H2 Green Steel will use the DRI-EAF steelmaking pathway using green hydrogen produced on site. Construction has already begun and the company announced in January 2024 that a further US$5.2 billion in funding had been raised for the project.

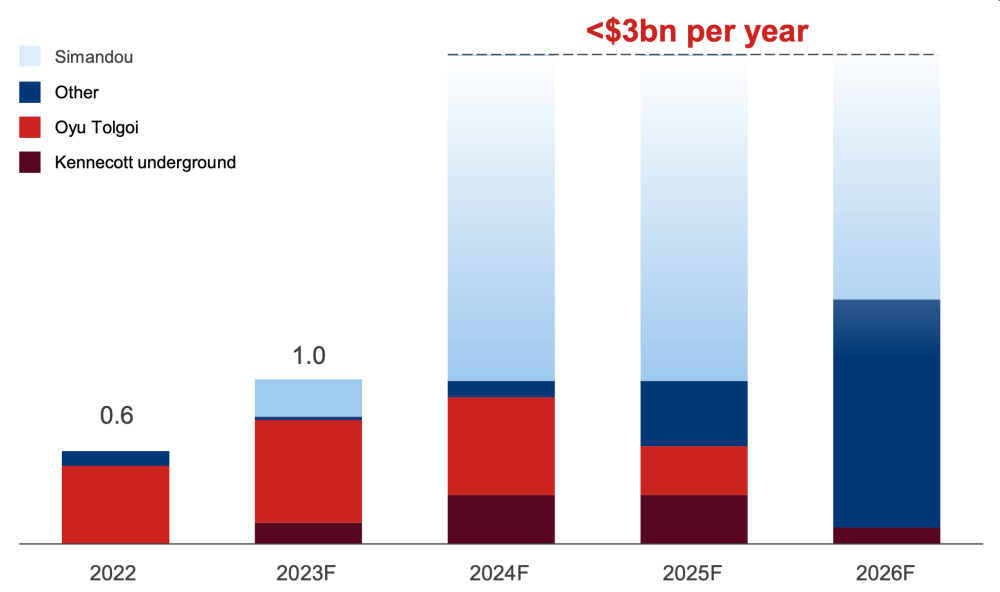

While Rio continues to invest in new Pilbara mining capacity, it recently announced significant capital expenditure figures for a major new mining investment overseas that will increase global supply of DR-grade iron ore.

Simandou in Guinea, West Africa, is the world’s largest untapped high-grade iron ore deposit, and Rio claims that the mining and infrastructure projects to unlock it will be the largest greenfield investment of its type in Africa. The mine has a 65% average Fe content and will produce DR-grade iron ore as well as blast furnace products with a higher Fe content than Pilbara ores.

Rio owns a 53% stake in one of the two mines under development along with its Chinese consortium partners. The company’s share of investment to co-develop one of the mines’ rail and port infrastructure is estimated at US$6.2 billion. A final investment decision on the project is expected in 2024.

Rio states: “Simandou will deliver a significant new source of high-grade iron ore that will strengthen Rio Tinto’s portfolio for the decarbonisation of the steel industry.” First production from the mine is planned in 2025, with output ramping up over 30 months to reach 60 million tonnes per annum (Mtpa).

Another mine at Simandou – whose venture partners include China Baowu – will produce a further 60Mtpa.

Figure 1: Simandou dominates Rio Tinto’s growth capital expenditure / SOURCE: Rio Tinto

Rio states that the Simandou project positions it for the decarbonisation of the steel industry by allowing it to supply low-carbon, DRI-based steelmakers. It also has a growing list of development projects aimed at reducing steelmaking emissions. Despite this, Rio still does not have a measurable Scope 3 emissions reduction target. The Scope 3 emissions produced when its steelmaking customers process its iron ore dwarfs Rio’s Scope 1 and 2 emissions.

Fortescue

Unlike Rio Tinto, Fortescue has set a measurable target to reach net zero Scope 3 emissions by 2040, by far the most ambitious target among its peers. As part of efforts to achieve this, Fortescue is also targeting African iron ore.

December 2023 saw the company’s first shipment from its Belinga iron ore project in Gabon – its first ever delivery from outside Australia. Details about the quality of iron ore to be produced from this project have been thin, but Fortescue has previously insisted that “every indication we have, shows the project has the potential to be significant scale and very high-grade”, and that “initial indications are that it could be similar in scale and size to Simandou in Guinea”.

Fortescue revealed that the first Belinga shipment had an Fe content in the “low 60s” but noted that this delivery was more about proving the logistics train, without a focus on grade. Full evaluation of the mine is underway, with the promise of more details – which could determine the extent to which the project can facilitate low-carbon steelmaking – to come.

Meanwhile, Fortescue is already producing and shipping iron ore in Australia containing more than 67% Fe, which meets DR-grade.

The Iron Bridge project may only be the first in a series of magnetite mines that Fortescue develops. Magnetite has a lower Fe content than hematite in situ, but it is easier to process up to DR-grade. In August 2023, Fortescue Metals CEO Dino Otranto stated: “Iron Bridge is a premium grade magnetite product, not only broadening our portfolio of products and providing diversification opportunities, but is also critically important in the energy transition to make green iron.”

Iron Bridge is in the process of ramping up production, though it hit a new problem in the form of a burst water pipe, which will reduce expected production in the current financial year and cost A$150 million to repair.

Going forward, magnetite looks set to play a growing role in supplying decarbonised steel operations. POSCO and Liberty Steel are planning low-carbon steelmaking projects in Australia based on magnetite and more mines are being developed.

BHP

In contrast to its peers, BHP is not targeting increased high-grade iron ore production. Its focus remains on expanding production of blast furnace-grade ore in the Pilbara.

Instead of chasing higher-grade ore, BHP’s Scope 3 efforts are focused on technology developments that could allow the use of its Pilbara ore in DRI-based steelmaking, as well as carbon capture, utilisation and storage (CCUS).

BHP’s insistence that CCUS will play a role in reducing steel emissions by decarbonising coal-consuming blast furnaces is hardly surprising – BHP is also the world’s largest shipper of metallurgical coal. However, the retrofitting of blast furnaces with CCUS units to reduce emissions is making virtually no progress.

The German think tank Agora Industry highlights that, since 2020, virtually all steel companies that plan to build low-carbon steelmaking capacity at commercial scale have opted for hydrogen-based or hydrogen-ready DRI plants, rather than adding CCUS to blast furnaces. The 2030 project pipeline of DRI plants has grown to 94Mtpa, while the pipeline for commercial-scale CCUS on blast furnace-based operations amounts to just 1Mtpa, according to Agora.

Despite the poor track record of CCUS across all sectors, BHP is pursuing carbon capture development projects with steelmakers HBIS and ArcelorMittal.

BHP’s reliance on CCUS looks highly unlikely to help it get near its “goal” to reach net zero Scope 3 emissions by 2050. As the company itself makes clear, a goal is not the same as a target. BHP does not have a measurable Scope 3 emissions reduction target.

What can we expect in 2024?

In 2024 we can expect to see a further acceleration in the steel technology transition away from coal, and increasing pressure on companies to act on their Scope 3 emissions.

Technology developments that allow the use of blast furnace-grade iron ore in DRI-based steelmaking solutions are likely to play an important role in steel decarbonisation and hence reducing the Scope 3 emissions of iron ore miners. The continuing poor track record of CCUS means it is unlikely to play a major role.

However, at this stage of the transition it looks like increased supply of DR-grade iron ore will also be important.

Differences in long-term iron ore supply strategies are already emerging in the face of growing steel decarbonisation momentum, with some of those strategies looking more likely to prove successful than others.

***

Simon Nicholas is the Lead Analyst for the global steel sector at IEEFA

This article is published with permission